With Brexit on the horizon and the United Kingdom (UK) government reaching out to develop closer ties with India, professional services firm Grant Thornton released a report detailing the contributions of Indian firms to the UK economy in terms of value generation and employment.

The analysis is based on data from the Confederation of Indian Industry (CII) and focuses on Indian-owned companies that are either headquartered or have a significant share of their operations in the UK.

“In the context of leaving the European Union (Brexit), the United Kingdom is looking to strengthen trade and investment with non-EU countries globally. India, as one of the fastest-growing economies in the world and as a member of the Commonwealth, is very much in the UK’s sights,” state the report's authors.

Based on different criteria, 850 firms active in the UK for the past two years or more were shortlisted. These firms:

- Employ at least 1,000 people in the UK each

- Cumulatively generated revenues of just under 48 billion pounds for this financial year, a billion more than for the last period

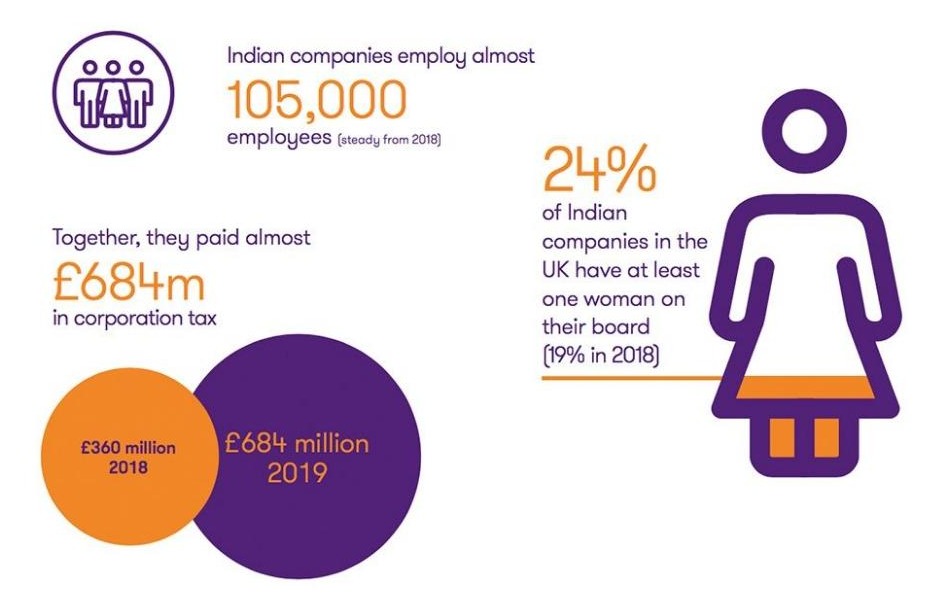

- Paid more than 684 million pounds in corporation tax over this financial year, almost double the 360 million last year

- Employed nearly 105,000 people across the UK for this financial year

The economic contribution of Indian-owned firms is strengthening the relationship between the UK and India as well, the report stated, adding that the contribution from Indian companies extends to other dimensions as well.

Showcased during the UK-India Business Week last month, the investment patterns of these firms revealed that Indian companies in the UK appeared unaffected by the ongoing Brexit negotiations and the related uncertainty. As per the report, Indian firms have only increased their investment in the UK in this period.

Ultra high net worth individuals in India appear to be investing in UK real estate more than anywhere else as well.