The Indian government has put to rest concerns about the dichotomy between Non-Resident Indians (NRIs) being ineligible for Aadhaar cards and having to link Income Tax returns and PAN numbers to Aadhaar numbers.

“NRIs will get an exemption from the government to maintain status quo. Since companies too do not get an Aadhaar number, they too would be exempt from the new rules,” sources in the Ministry of External Affairs said.

“The proposed amendment in the Finance Bill says Aadhaar will be mandatory only for those who are ‘entitled’ to enrol under the scheme. Since NRIs and firms are not entitled to Aadhaar, they are outside the new provisions,” Indian Finance Minister Arun Jaitley announced.

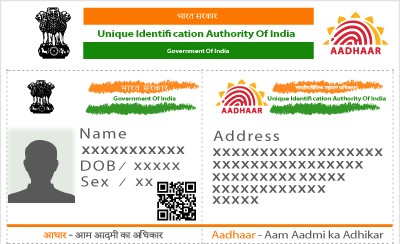

Although NRIs are exempted from income tax on their income abroad, they have to file tax returns for their income earned in India. The Indian government has exempted NRIs from the requirement of quoting Aadhaar (Indian biometric ID card) number while filing income tax returns back home.

On March 30, a top Indian official clarified that NRIs were not eligible for Aadhaar and government departments had to give exemptions to NRIs in this regard.

“It is the responsibility of the relevant departments to give exemption to NRIs [on Aadhaar requirement],” Dr Ajay Bhushan Pandey, CEO, Unique Identification Authority of India (UIDAI), had said from New Delhi. The departments should get a declaration from the NRI that he or she is not eligible for Aadhar card, he had said.

Last week, India’s Central Board of Direct Taxes (CBDT) in a press release had stated that the requirement to quote Aadhaar for filing income tax returns and for making an application for allotment of PAN with effect from July 1, 2017, shall not apply to NRIs.

Clarifying on the definition of who a resident is, the statement said: "Resident is an individual who has resided in India for a period or periods amounting in all to 182 days or more in the 12 months immediately preceding the date of application for enrollment. Accordingly, the requirement to quote Aadhaar as per Section 139AA of the Income Tax Act shall not apply to an individual who is not a resident as per the Aadhaar Act 2016."

The CBDT has exempt certain sections from this mandatory linking. In a notification issued by the government, the details of which are available on the official website of CBDT, the following sections of people are exempted from linking Aadhaar with PAN:

- An individual who is residing in the state of Assam, Jammu and Kashmir and Meghalaya.

- An individual who is a non-resident Indian or NRI as per the Income Tax Act, 1961.

- An individual of the age of eighty years or more at any time during the previous year.

- An individual who is not a citizen of India.

The above-mentioned group of individuals are exempt from the mandatory linking only if they do not have Aadhaar.

Welcoming the move, Indian expatriates in the UAE said all other government departments and private players should also give similar exemptions to NRIs for all services and transactions. However, some felt that the Aadhaar card service should cover NRIs as well, in case they returned to India permanently.