COVID-19 has got the entire world fighting against a common problem. However, each country has dealt with the crisis in a completely different way. Some countries like Singapore and Hong Kong have been able to contain the virus effectively, while others such as Italy and Spain have suffered immensely. From an investor’s perspective, times like these are a good reminder of why having your complete portfolio tied to one country’s fate can be dangerous. One misstep from a country’s leadership can send the entire economy, and along with it the stock market, in a downward spiral. Therefore, it is only wise to not have your investments completely dependent on one country.

Diversifying your investments geographically helps reduce not only country risk, but also currency risk. The INR has annually depreciated on an average about 4% against the USD over the last 10 years. So, while your portfolio might have given great INR returns, on a global level the returns would not look pretty. The easiest way to understand the impact of the currency depreciation is to look at returns of the Sensex versus the Dollex (the USD version of the Sensex). Over the last 10 years, the Sensex has given an absolute return of 135%, whereas the Dollex has returned 51%.

As an NRI, you are in a great position to be able to diversify your portfolio geographically. In terms of which markets to invest in – a combination of the US and India markets provide an investor all the optionality that one would need. The US markets offer the opportunity to invest in a wide range of low-cost ETFs as well as global brands like Apple, Google, Netflix, and Starbucks. On the other hand, the India markets provide the opportunity to invest in companies that have grown up using and also gives our portfolio exposure to a high growth emerging economy.

Having lived in India, we all know why one should invest in the India market – the growth potential, stable government, rapidly increasing wealth, young demographic, and more. But why specifically the US markets along with the India markets? Here are three reasons why:

Low correlation between the two markets

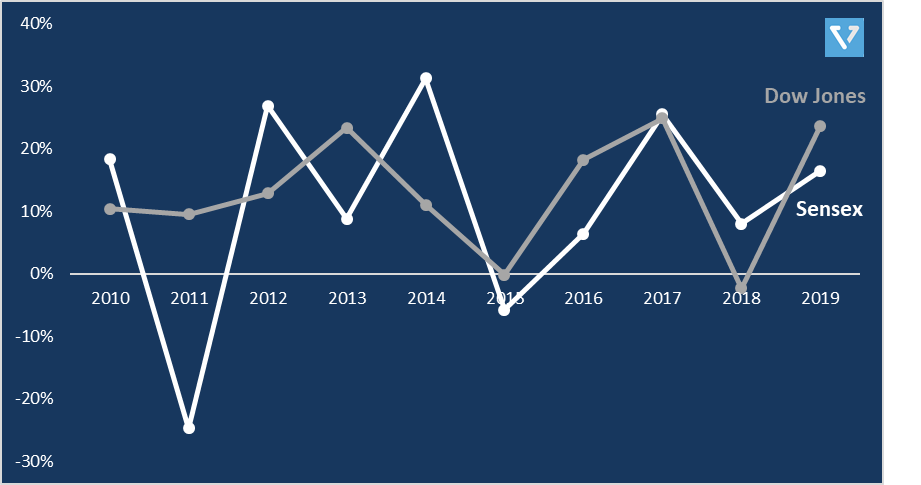

The basic rule of diversification is that you want to invest in assets whose returns are not correlated to each other i.e. if one investment’s return goes down, the other one balances it out. Finding perfectly uncorrelated assets is a challenge, however one should try to minimize it to create an efficient portfolio. The correlation between the Sensex and the Dow Jones (Sensex equivalent in the US) is very low (it’s only 0.36). This means that investing in India and the US is a good way to achieve diversification.

US markets have outperformed the India markets in dollar terms

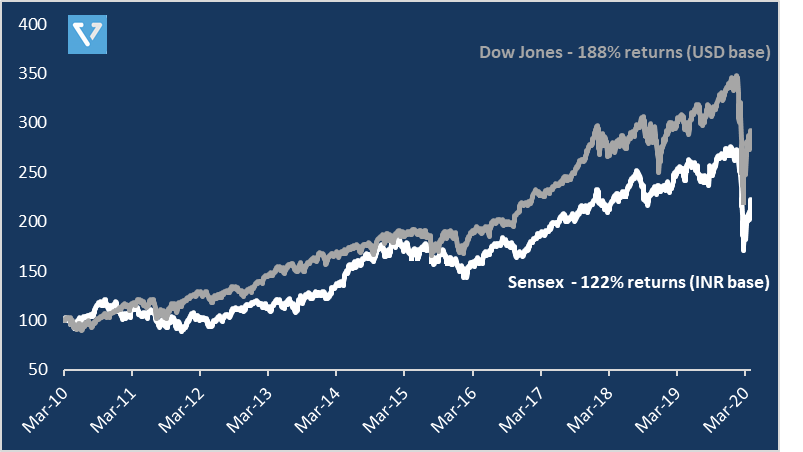

Over the last 10 years, the US markets have actually outperformed the India markets. This has largely been due to the rapid pace of technology innovation in the US. If we compare the returns of the Dow Jones with the Sensex, over the last 10 years the Dow has returned 188% whereas the Sensex has returned 122%.

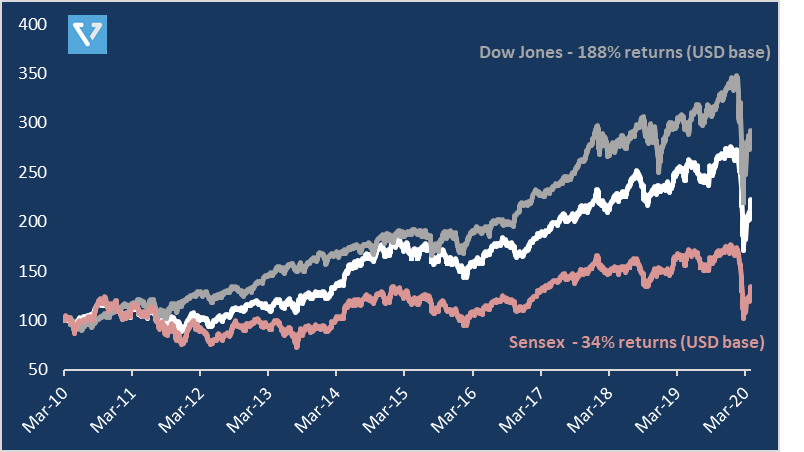

Now if you add to it the INR depreciation that has happened over the last 10 years, there is an even larger difference in the returns. When the returns are converted to USD, the DOW still returned the same 188%, however the Sensex return drops to 34%. This is because the INR has depreciated from 50 per USD to 75 per USD over the last 10 years.

You can own the entire globe’s equity through the US

The US markets actually provide the opportunity to invest in the entire globe’s equity and debt markets. One can invest in companies that are based elsewhere but listed on the US exchanges. These are companies such as – Alibaba, Toyota, and Spotify. One can also invest in ETFs that invest in global equities and bonds. ETFs such as Vanguard’s VT (holds the world’s stock market) and BNDW (holds the global bond market). Lastly, one can make country specific bets by investing in ETFs that invest in various markets such as MCHI (invests in China) or EWZ (invests in Brazil).

In conclusion, geographic diversification is a very important component of one’s investment portfolio. Investing in India and the US markets provides the opportunity to invest in fast growing and global companies at the same time. There are various cost-effective platforms that simplify US stock investing. If you’re in the US then you have a whole lot of options, for NRIs outside of the US, the options might not be as many. We at Vested allow all non-US NRIs to invest in the US markets in a commission-free and easy manner.

Disclaimer: Opinions expressed in this article are the author's personal opinions and do not reflect the views of Connected to India. The management of the company does not assume any responsibility or liability for the article.