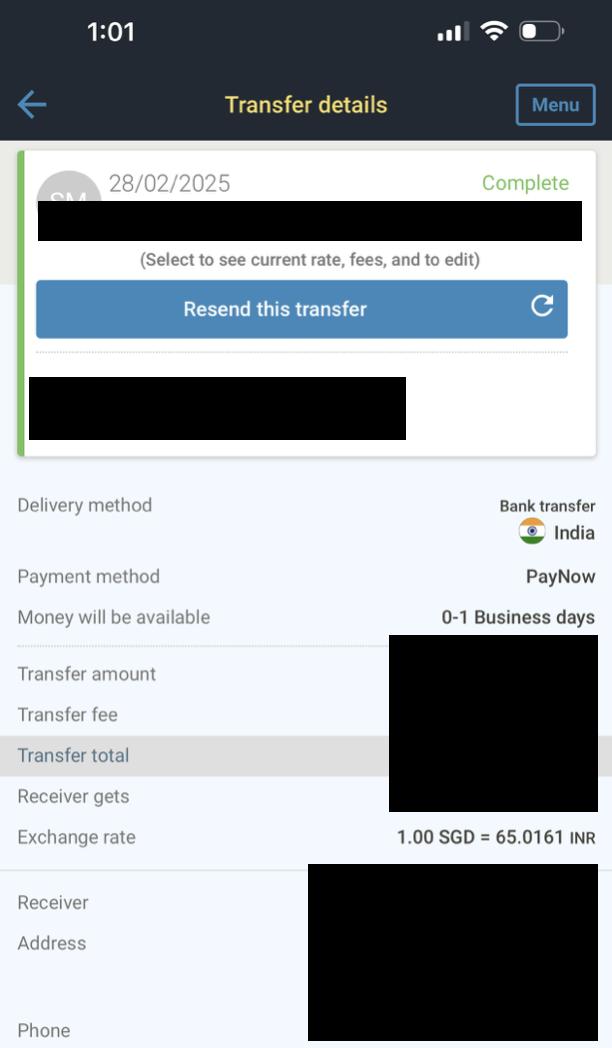

There was a frantic exchange of messages among NRI community in Singapore when one of person’s transferring cash back to India hit an exchange rate of INR 65 on the Western Union app.

Category: Personal Finance

Diwali 2024: Be alert and don’t shop till you drop into an online scammer’s trap

The festival of Diwali is just days away, and for Indians everywhere, it means cherry-picking the best buys from an explosion of online shopping offers. However, in this day and age, a dealfest also means that cyber-crooks are just as much out there, picking their targets.

The best times to trade forex

The forex market is highly volatile, but some trading hours are more favorable than others. Keep reading to discover the best times to trade.

Trading beginner? These are common mistakes!

Trading beginner? These are common mistakes you should avoid by any chance! Here we have all the information for you. Read more in this article!

Singapore world’s 17th most expensive location for expats: Survey

Singapore has emerged as the 17th most expensive location across the world for expatriates, with the average pay package for a mid-level worker costing companies USD 225,171 annually, a survey by MyExpatriate Market Pay published by ECA International, said.

When is the right time to buy Term Insurance?

Tussle between urgent versus important impacts financial planning in a big way. It is very common for people to constantly delay buying insurance because there are immediate expenses to deal with like school fee, home rent, appliance installments, car loan and so on.

India real estate: Safeguarding against fly-by-night operators

The Indian real estate market has always attracted considerable interest from the expatriate Indian diaspora.

Panglossian outlook and deepening of the India Bonds Market

Global central banks have moved to a rate softening regime to boost slowing economic growth. This has fuelled bond market rallies worldwide.

India Bonds: Lower inflation to enthuse investors

The Reserve Bank of India (RBI) cut its policy rate by 35 basis points to 5.40% on August 7 2019 and has cut the rate by a total of 110 basis points this year following cuts in February, April and June. It was a pleasant surprise for the bond market that was expecting a 25 basis points cut, with an

India Equity: Types of equity mutual funds available for investments

On June 1, 2018, investing in equity mutual funds in India got a tad easier thanks to a directive on scheme categorization (or recategorisation) to all Asset Management Companies (AMCs) by India’s capital markets regulator Securities and Exchange Board of India (SEBI).