The Singapore Airlines (SIA) Group’s revenue reached a record SGD 5,219 million in the three months ended 31 December 2024, up SGD 137 million (+2.7 percent) from the same period last year, spurred by robust demand for air travel in the third quarter of FY2024/25, an official report published on February 20 said.

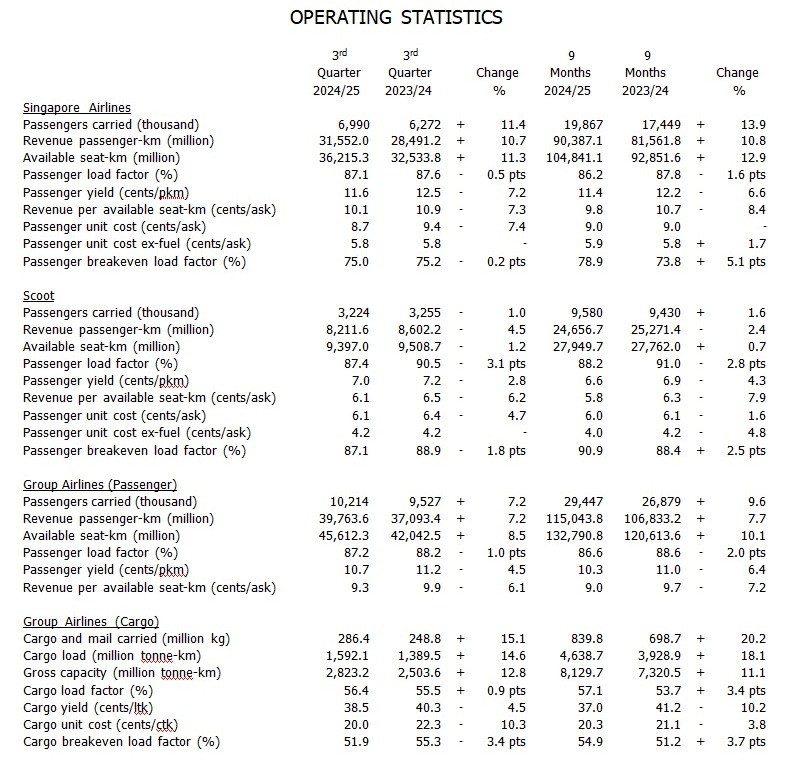

Passenger flown revenue improved by SGD 70 million (+1.7 percent), with SIA and Scoot carrying a quarterly record of 10.2 million passengers, up 7.2 percent from the third quarter of FY2023/24.

Group passenger load factor fell by 1.0 percentage point to 87.2 percent, as the 7.2 percent growth in passenger traffic lagged the capacity expansion of 8.5 percent.

Greater competition due to industry capacity injection continued to put pressure on yields, which dipped 4.5 percent to 10.7 cents per revenue passenger-kilometre.

Cargo flown revenue increased by SGD 54 million (+9.7 percent), with loads up 14.6 percent year-on-year, bolstered by robust demand due to strong e-commerce activity, a step up in freighter charters, and a boost in perishables traffic. Cargo capacity rose 12.8 percent while the cargo load factor was 0.9 percentage points higher at 56.4 percent, with yields 4.5 percent lower.

Group expenditure grew SGD 117 million (+2.6 percent) to SGD 4,590 million, driven by higher non-fuel expenditure of SGD 258 million (+8.6 percent), and partially offset by the decline in net fuel cost of SGD 142 million (-9.8 percent).

Effective cost management measures kept the rise in non-fuel expenditure below the growth in overall capacity (+10.1 percent), despite inflationary pressures. Net fuel cost was lower due to a 20.9 percent drop in fuel prices before hedging (-SGD 359 million), partially offset by the higher volume uplifted (+SGD 162 million), and the swing from a fuel hedging gain in the previous year to a loss (+SGD 98 million).

Consequently, the Group recorded an operating profit of SGD 629 million for the third quarter of FY2024/25, SGD 20 million (+3.3 percent) higher than the same quarter in the previous year.

The Group’s net profit rose SGD 967 million (+146.7 percent) to SGD 1,626 million, predominantly due to the SGD 1,098 million non-cash accounting gain resulting from the disposal of Vistara, following the airline’s merger with Air India in November 2024.

ALSO READ: Singapore Airlines to inject USD 378 million into Air India post Vistara merger

April to December 2024 profit and loss

Group revenue reached a record SGD 14,716 million for the nine months to 31 December 2024, up SGD 472 million (+3.3 percent) compared to the same period in the previous year.

This was led by the rise in passenger flown revenue of SGD 189 million (+1.6 percent) and cargo flown revenue of SGD 96 million (+5.9 percent).

Heightened competition resulted in lower passenger yields (-6.4 percent) and cargo yields (-10.2 percent) year-on-year. Operating expenditure increased SGD 1,210 million (+10.0 percent), in line with the overall capacity expansion of 10.5 percent.

Net fuel cost was SGD 305 million (+8.2 percent) higher mainly from an increase in volume uplifted (+SGD 437 million) and lower fuel hedging gain (+SGD 274 million), partially offset by an 8.1 percent fall in fuel prices (-SGD 367 million). As a result, the operating profit fell SGD 738 million (-34.1 percent) to SGD 1,425 million.

Despite the lower operating profit, the Group net profit was SGD 268 million (+12.8 percent) higher on the back of the non-cash accounting gain following the merger of Vistara with Air India in November 2024.

Balance sheet

The Group’s shareholder equity stood at SGD 15.4 billion as of 31 December 2024, down SGD 1.0 billion from 31 March 2024, primarily due to the redemption of the remaining Mandatory Convertible Bonds (MCBs) in June 2024. Total debt balances remained at SGD 13.3 billion, with the debt-equity ratio rising from 0.82 times to 0.87 times.

Cash and bank balances declined by SGD 3.0 billion to SGD 8.3 billion, mainly due to the MCB redemption (SGD 1.7 billion), FY2023/24 final dividend and FY2024/25 interim dividend payments (SGD 1.4 billion), capital expenditure disbursements (SGD 1.4 billion), as well as the investment in Air India (SGD 0.8 billion).

This was partially offset by SGD 3.2 billion in net cash generated by operations. The Group also held SGD 1.3 billion in fixed deposits with tenors exceeding 12 months, classified under other assets. In addition, the Group currently maintains access to SGD 3.3 billion of undrawn committed lines of credit. The Group’s balance sheet remains among the strongest in the industry.

Fleet and network development

As of 31 December 2024, the Group’s operating fleet comprised 207 passenger and freighter aircraft with an average age of seven years and six months.

SIA added one Airbus A350-900 in December 2024, giving it 146 passenger aircraft1 and seven freighters.

Scoot added three Embraer E190-E2 aircraft in the third quarter, bringing its operating fleet to 54 passenger aircraft2. The Group has 81 aircraft on order3.

SIA launched services to Beijing Daxing (China) in November 2024, while Scoot began Embraer E190-E2 operations to Malacca (Malaysia) in October 2024 and Phu Quoc (Vietnam) in December 2024.

As of 31 December 2024, the Group’s passenger network covered 129 destinations in 36 countries and territories4, with SIA serving 80 destinations and Scoot serving 72 destinations. The cargo network reached 133 destinations in 37 countries and territories.

Following the launch of flights to Padang (Indonesia) and Shantou (China) in January 2025, Scoot will introduce twice-weekly services to Iloilo City (the Philippines) on 14 April 2025 and increase that to four-times weekly from June 2025.

Scoot will also start thrice-weekly direct services to Vienna (Austria) on 3 June 2025. SIA will ramp up services to Brisbane (Australia), Colombo (Sri Lanka), and Johannesburg (South Africa) during the Northern Summer 2025 operating season (30 March 2025, to 25 October 2025).