The wealthy nation of Singapore, which saw the last sentencing in an SGD 3 billion money-laundering case in early June, has now released a comprehensive Money Laundering National Risk Assessment (MLNRA), put together by the Ministry of Finance, the Monetary Authority of Singapore, and the Ministry of Home Affairs.

Released yesterday, the MLNRA identified various avenues of money laundering. It also described the role of Singapore law enforcement agencies (LEAs) in combating money laundering (ML).

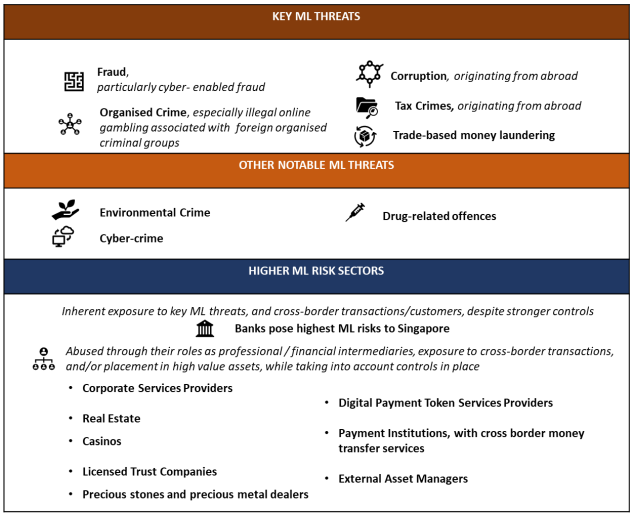

While real estate and precious metals and stones, which have long been the instruments of laundering money, remain among high-risk sectors, newer high-risk sectors include digital payment token service services, cross-border money transfer services, and external asset management. Casinos, too, are in this sector.

Banking is the highest-risk channel of money laundering in Singapore, as per the assessment. It said: “Most commonly observed ML typologies [are] – (i) Rapid pass-through of funds through bank accounts, (ii) misuse of legal persons such as shell companies, and (iii) placement in high value assets.”

The report presented dozens of case studies, and outlined the work of national LEAs. It said: “Singapore has three key LEAs investigating money laundering – the (i) Singapore Police Force, which includes the Commercial Affairs Department (CAD), and Criminal Investigation Department (CID), (ii) Corrupt Practices Investigation Bureau (CPIB), and (iii) Central Narcotics Bureau (CNB).

“There are also other LEAs in Singapore who are responsible for investigating the predicate crimes, such as Inland Revenue Authority of Singapore (IRAS), Singapore Customs (Customs), National Parks Board (NParks).”

Being an open economy, Singapore is “exposed” to several external threats. The assessment said: “As an international business, financial and trading centre, Singapore is exposed to external threats arising from predicate offences that have a foreign nexus.

“Notably, Singapore LEAs see a high number of ML cases arising from foreign fraud, particularly cyber-enabled fraud. Fraud is also the most frequently cited offence in foreign authorities’ requests to Singapore for assistance, through both the Suspicious Transaction Reporting Office (STRO) and LEAs. It is also increasingly a key crime of concern globally.

“Authorities have observed that fraudulent proceeds are often professionally laundered and facilitated through third parties, such as multiple layers of corporate and individual mules and nominees, as well as through the financial and DNFBP (designated non-financial businesses and professions) sectors. In addition, Singapore’s engagements with other jurisdictions have identified fraud to be the top predicate crime of concern posing an ML threat to Singapore.”

Cyber-enabled fraud within Singapore’s borders is also a top concern, especially as the fraud masterminds are often somewhere outside Singapore jurisdiction and use social media to find their victims.

The assessment said: “Over the years, Singapore has also observed an increase in ML threat posed by cyber-enabled fraud committed domestically, orchestrated by syndicates typically located overseas. STRO and LEAs in Singapore note the abuse of mule networks, and the use of nominees in these well-orchestrated arrangements.

“This threat has been exacerbated by advancements in digitalisation, which allow syndicates to broaden their reach to the mass public through the abuse of social media platforms and transcend borders to launder their ill-gotten gains.”

In order to counter this, Singapore worked with INTERPOL and the Egmont Group, a global organisation of financial intelligence units (FIUs) to develop a report on ‘Illicit Financial Flows from Cyber-Enabled Fraud’.

The report was issued by the Financial Action Task Force, the intergovernment organisation that functions as a global money laundering and terrorist financing watchdog.

On June 30, 2024, Singapore ends its two-year presidency of FATF, which began on July 1, 2022. The island nation has been represented by T Raja Kumar, an Indian-origin Singaporean who has had senior leadership roles in the Ministry of Home Affairs in Singapore and the Singapore Police Force for over 35 years.

Referring to the recent SGD 3 billion ML case, the assessment said: “Another key ML threat faced by Singapore arises from foreign organised crime, and in particular, illegal online gambling. In the recent money laundering case, which involved over S$3b worth of seized and prohibited assets, several of the accused persons were convicted of laundering proceeds, which were suspected of being the benefits of illegal online gambling from foreign organised criminal groups.”

Giving details of how this SGD 3 billion was laundered, the assessment said: “Some of these monies were held in bank accounts in Singapore. Others were converted into assets such as real estate, cars, handbags and collectibles. Aside from banks, other sectors were involved in the offenders’ management of their assets (for instance, they had engaged CSPs to incorporate companies in Singapore through which they held their assets, purchased properties through real estate salespersons, and placed their funds in other high value goods through precious stones and precious metals dealers).”

Case studies cited in the Money Laundering National Risk Assessment of Singapore

● Case Study 1: Singapore’s assistance in securing the conviction and penalties against Bernie Ecclestone

Singapore was a crucial partner in the conviction of Bernie Ecclestone on 12 October 2023, and the recovery of assets involved in the criminal activity.

The United Kingdom tax authority, His Majesty’s Revenue and Customs (HMRC), had launched a lengthy, complex and worldwide investigation into his tax affairs since more than a decade ago, against Formula One motor racing boss, Bernie Ecclestone. He failed to declare a trust which held assets of more than GBP 416 million.

Bernie Ecclestone had claimed that he was not the settlor or beneficiary of any offshore trust based on interviews with UK tax investigators in 2015. However, information was proactively shared by Singapore authorities with UK authorities through the FIU and LEA channels to provide crucial support to the UK’s investigations and showed that claims were untrue. The close cooperation between CAD, STRO and the relevant UK authorities is testament to Singapore’ commitment to international cooperation, to achieve effective outcomes in the common fight against transnational crime.

Bernie Ecclestone was eventually sentenced to 17 months in prison, suspended for two years in London, and has made a payment of more than GBP 650 million in relation to his tax affairs, covering tax penalties and civil penalties.

● Case Study 4: ML threats and risks in Singapore’s recent major money laundering case

On 15 August 2023, ten suspects were arrested in a series of simultaneous raids at multiple locations across Singapore. As part of the ongoing investigations, more than SGD 3 billion of suspected illicit financial and physical assets, including cash, cryptocurrencies and luxury goods were seized or prohibited from disposal, in one of Singapore’s largest anti-money laundering operations.

This operation was achieved arising from the close cooperation and coordination of actions among law enforcement, intelligence (including STRO) and supervisors (such as MAS and ACRA).

● Case Study 11: Network of money mules in Singapore used to launder proceeds for foreign syndicates

In late 2021, Singapore was hit by a series of phishing cyber-enabled fraud involving spoofed SMS messages, and in some of the instances, actual and look-alike sender-IDs of local banks were used.

In one of the series, more than SGD 13.7 million was lost, affecting 790 victims. The fraudsters involved are typically part of organised criminal syndicates and run sophisticated transnational operations, which are not easy to detect or dismantle. The syndicates are also well-resourced and adept at using technology to cover their tracks.

Thus far, 121 local bank accounts and 89 overseas accounts have been identified to have received proceeds of the fraud. In one instance, the money mules recruited in Singapore were promised a fixed salary of 3,000 dollars a month, with an additional 600 to 800 dollars for each bank account provided to the syndicates in Telegram chat groups between Dec 2021 and Jan 2022.

The unauthorised transactions were made to money mules with local bank accounts. Typically, after the funds were received in the local mule’s account, they would be (i) withdrawn in cash via ATM, (ii) transferred to another local bank account, (iii) transferred to overseas accounts, or (iv) used to top up e-wallets. The scam proceeds were eventually transferred out of Singapore to other countries. Nine persons were charged for their involvement in this case.

As of May 2024, seven of them have been convicted of offences under the CMA, Penal Code and CDSA and, depending on their level of involvement, were given sentences ranging from 18 months’ supervised probation and reformative training to 15 months’ imprisonment.