What's at stake?

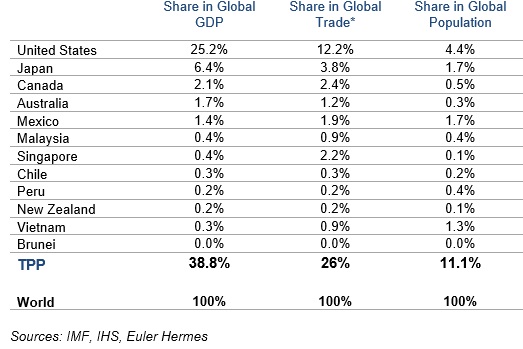

President Trump made good on his campaign promise to withdraw the United States from the Trans-Pacific Partnership. The 12-nation free trade agreement was an ambitious attempt to promote trade on a mega-scale. Now US' support is officially withdrawn, so gone is the aspiration of bringing together 800 million consumers, close to USD28tn of wealth (36% of global GDP) and USD11tn in trade (exports and imports i.e. 26% of global trade). This new trade framework could have boosted TPP member countries' GDP by +USD38bn over the first two years of implementation.

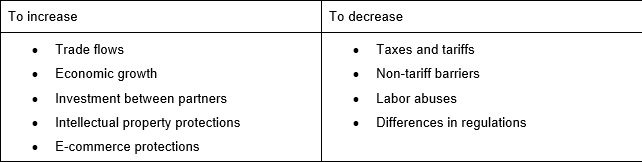

In addition to the extensive trade liberalization in goods and services via the reduction of tariff and non-tariff barriers, the agreement was also intended to promote fair labor competition, freer investment movement, enforcement of intellectual property (IP) rights, and the harmonization of legal and regulatory issues:

TPP members' key figures

Weak global trade

The global trend of trade is already weak. For the full year of 2016, first trade releases point that USD denominated exports dropped in China (-7.7%), in South Korea (-5.9%) and Singapore (-4.9%). We expect a limited improvement in 2017. Global trade volume growth will stay modest, below +4% in the medium-term: we forecast +2.9% in 2017, after a record low at +1.9% in 2016.

Regime switch in demand (China's rebalancing; energy autonomy in the US; adjustments in the emerging world), isolationism and servitization/digitalization explain this daunting trend.

Protectionism has been intensifying over the past years: 700+ new restrictive measures were introduced each year between 2012 and 2015. 567 trade barriers were issued during the first nine months of 2016 while indirect protectionism is also on the rise (public procurement, subsidies, compensation).

In that context, Asia will need to find new trade drivers.

Where's hope?

Driver #1: The One Belt One Road Initiative

Firstly, for ASEAN TPP members, namely Singapore, Malaysia, Vietnam, the Chinese-led One Belt One road initiative could be a good alternative. The latter consists in improving connectivity and economic cooperation in Asia, Europe, the Middle East and Africa thanks to massive infrastructure investment plans.

The impact could be felt through a capital boost in countries which could result in more funding to finance infrastructure projects. Secondly, it would go through a gradual increase in demand from China for strategic natural resources. Another channel would the rise in competitiveness as infrastructure for trade improves. Singapore could also leverage on its edge in financial services and logistics operations to advice and support companies expanding their business in the region.

Driver #2: Regional Comprehensive Economic Partnership

Secondly, Asia Pacific markets can bet on other partnerships. The countries can move towards further regional integration with the promotion of the Regional Comprehensive Economic Partnership (RCEP).

This mega-trade agreement which involves China, ASEAN, Australia, New Zealand, India, South Korea, and Japan represents a market worth around USD22tn, gathers 3.5bn people. It aims at liberalizing goods and services trade, facilitating investment flows and promoting best practices.

Disclaimer: Opinions expressed in this article are author's personal opinions and do not reflect the views of Connected to India and the management of the company does not assume any responsibility or liability for the article.